At the beginning of April a disturbing message appeared in the press. De Financiële Telegraaf reported that failed takeovers in SMEs (small and medium-sized enterprises) would cost 100,000 jobs annually. This was the result of research conducted by Lex van Teeffelen.

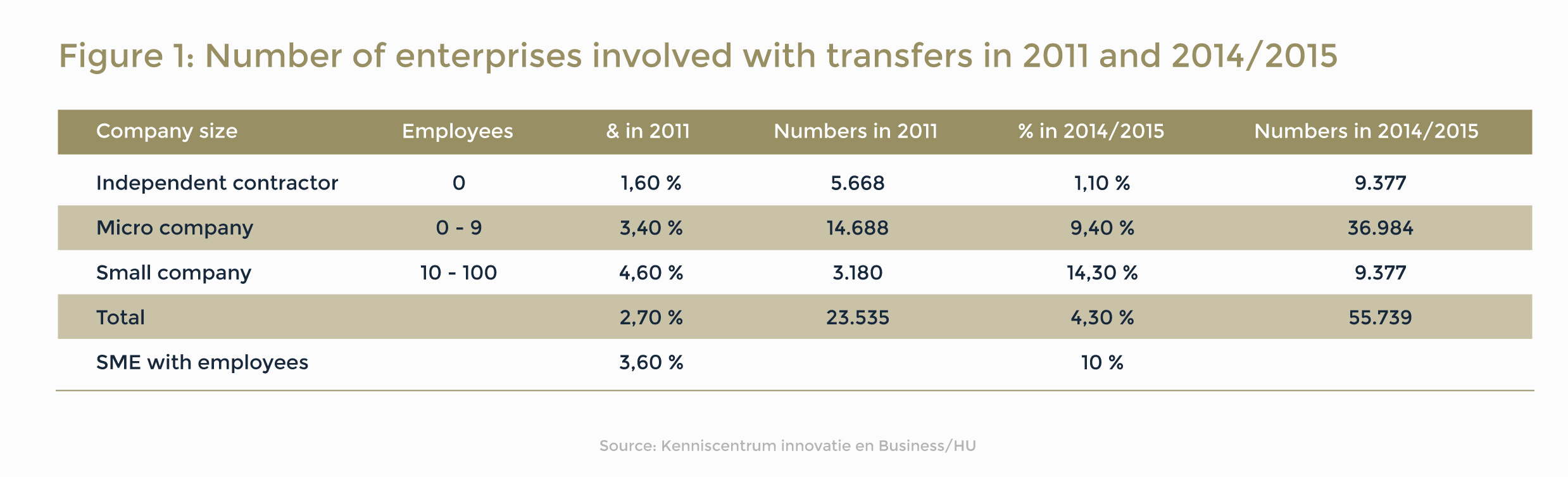

In his research Van Teeffelen establishes that the number of SMEs for sale in 2014/2015 has increased rapidly in comparison to 2011. The number has almost tripled and had amounted to 55,739 at the time of the research, of which more than 46,000 had employees. This high number is not surprising considering that in 2014/2015 the economy had slightly recovered, and it is a known fact that entrepreneurs would rather put their enterprise up for sale in economically favourable times, as it would expected a better price could be negotiated.

It is striking that there are so many family enterprises for sale at the moment, and that the age of the entrepreneur selling his enterprise is now 60 years old compared to 50 years old in 2011. The higher average age shows that the motivation for the enterprise transfer, is the retirement of the entrepreneur. There’s an obvious downside to this advanced age. If the intended transfer fails, there is often no second chance leading to the threat of discontinuance of the enterprise.

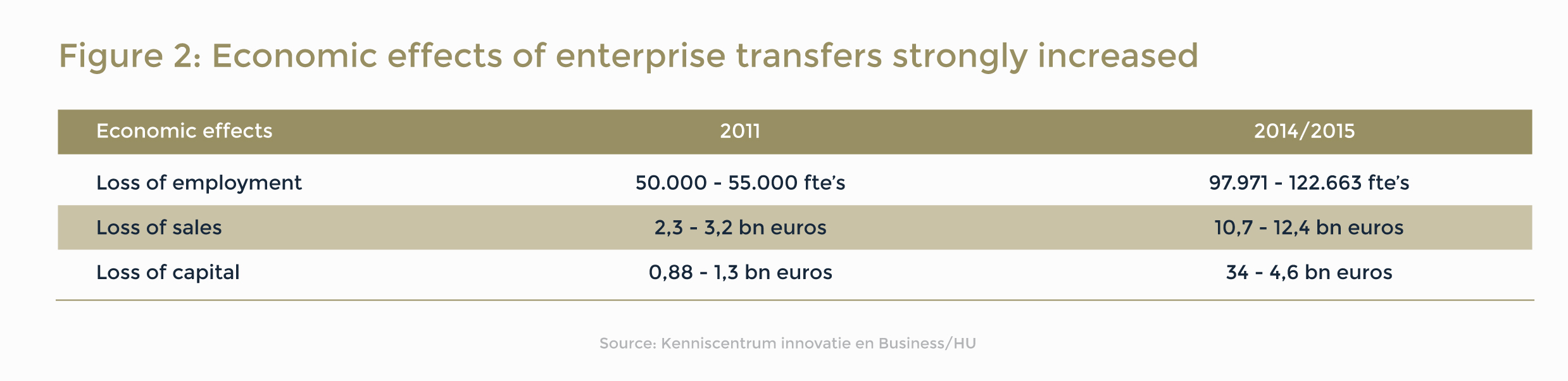

Currently about 10% of the total amount of SMEs is for sale, and together these enterprises account for 7.1% of all fulltime jobs in the Netherlands. The obvious conclusion is that the Dutch economy has a strong interest in the transfers of these enterprises running smoothly. Van Teeffelen has estimated that, in comparison to 2011, as a result of failed transfers, the impending loss of employment has doubled, and the capital loss has even quadrupled.

However, the above is the worst case scenario. Enterprise transfers also have a lot of positive effects. Successful enterprise transfers provide for more employment, and the survival rate is much higher than for start-ups. The survival rate for start-ups is approximately 35-50%, whereas for transferred enterprises the chance of success is at least 90%. Research has shown that a well-run enterprise transfer has a positive impact on innovation, and thus also on economic growth.

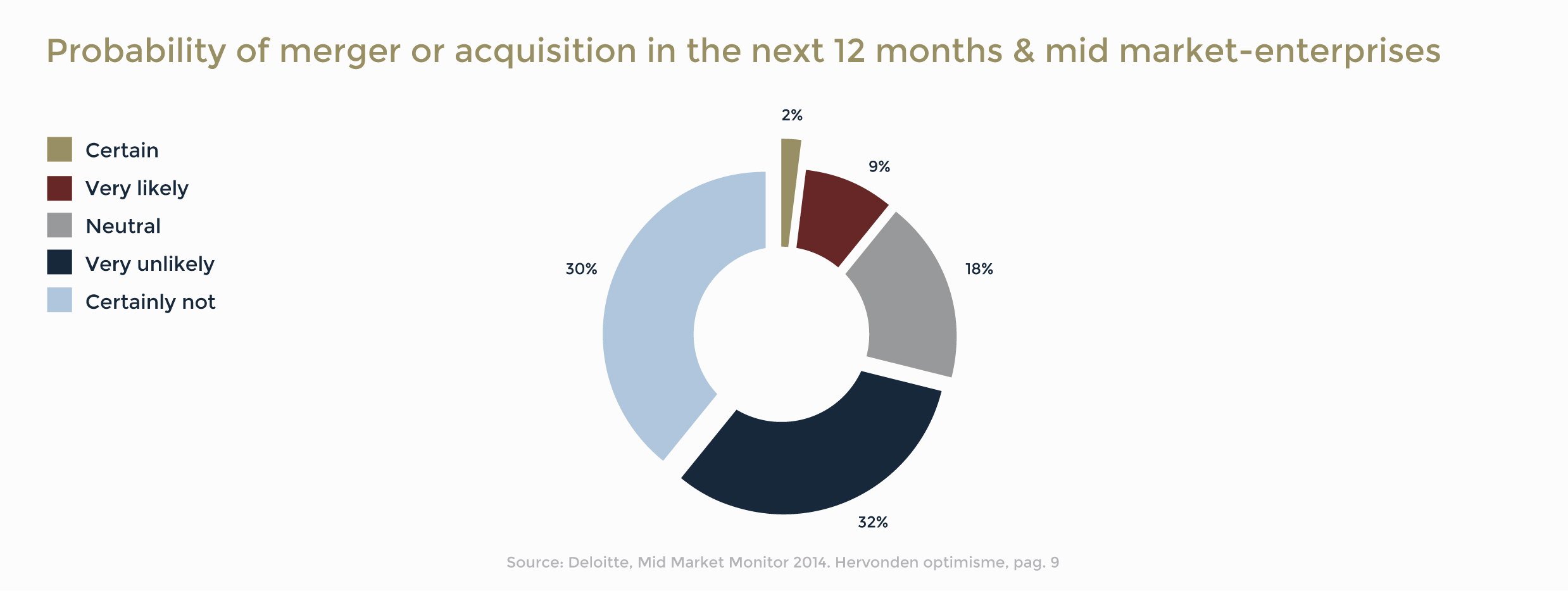

The chance that this will now also be the case, is large. Van Teeffelen establishes that the quality of the enterprises for sale now is better quality than those in, say, 2011. He describes them as innovative and strong in the field of export. The good news does not stop there. A recent survey by Deloitte shows that a growing number of entrepreneurs does not only want to sell from the SME sector, but also wants to buy. More than 34% of the respondents believed they would be involved in a merger and/or acquisition in 2014. The underlying cause of this line of thought was, and is, the regained confidence in SMEs.

Thus, there is every reason for optimism and to believe that the economic damage will be less than expected. However, the major obstacle to overcome is financing. It is extremely difficult for potential buyers to find financing. Banks refuse to cooperate when potential buyers seek financial assistance. When it comes to Banks financing enterprise transfers, the Netherlands takes an embarrassing 71st place. Countries such as Namibia and Mongolia experience more flexible conditions and have greater access to bank loans. For this reason Arnoud Boot, professor of Corporate Finance and Financial Markets, calls out to external funders and institutional investors, private equity firms and other outside investors to take their social responsibility, in the Deloitte study. They can and should contribute towards financing and strengthening of the equity of the enterprises involved. In his view, a greater involvement from external funders and investors is the only way to break the dependency on the large banks. Arnoud Boot also highlights the importance of mergers and acquisitions for innovation and employment.

Arnoud Boot more or less seems to be waited on hand and foot. A report by the Nederlandse Vereniging van Participatiemaatschappijen (The Dutch Association of Outside Investors, NVP) shows that in 2014 outside investers invested an amount of €3.1 billion in 387 enterprises. That is €700 million more than in 2013, when 2.4 billion was made available for 331 enterprises. Characteristic for these investments is that 89% of the cases involves enterprises with an equity of less than €5 million. An investment of up to €5 million would typically go towards a starter or a fast growing SME. In the Netherlands in 2014, 32 buyouts were facilitated with less than €5 million, compared to 27 buyouts in 2013.

Also interesting to note is that more was invested in medium-sized enterprises, with investments between €5 and €50 million. These included remarkably large follow-up investments.

While Van Teeffelen establishes that now in 2014/2015 mainly the entrepreneur-shareholder is looking for a potential enterprise transfer, the NVP notices another trend. Nowadays, it is no longer just the traditional manager-owner who is searching for an outside investor to help facilitate his retirement, more and more young entrepreneurs are finding their way into the world of outside investors. They hope that the contribution of these outside investors will gradually guide them towards the next phase, and therefore deliberately turn to these outside investors to help them. A merger or an acquisition could help with this. The NVP’s claim that outside investors are the main party to provide SMEs with capital, is in any case supported by facts and figures.